As our world grows increasingly digital, the way we conduct business, shop for products, and communicate with one another has evolved, particularly through the expanding realm of mobile devices. This widespread adoption of smartphones and tablets has revolutionized the payment landscape, enabling businesses to leverage these devices for seamless transaction experiences. Consequently, this has led to the rise of two distinct types of payments conducted via smartphones and tablets: in-app payments and in-person payments.

In-app payments refer to transactions made within a mobile application to access premium content or services, make purchases, or pay bills. These transactions do not require the customer or the merchant to be physically present, and funds are transferred digitally. On the other hand, in-person payments involve transactions taking place between a customer and a merchant who are physically present at the point of sale (POS).

In this article, we will focus on in-person payments and explore various strategies for making these transactions more efficient by reducing the dependency on multiple devices, ultimately enhancing the experience for both merchants and customers.

Simplifying payments: the delivery example

The growth of mobile apps has transformed the relationship between customers and merchants, making everything from retail to transportation services available with the swipe of a finger. However, receiving payment for in-person transactions has remained relatively inconvenient and inefficient, as exemplified by the parcel delivery business.

In traditional parcel delivery services, customers may prefer to make a payment for the services at the time of delivery, making it crucial for delivery personnel to have an efficient payment processing system in place. However, this process requires two separate devices: one for scanning the parcel's barcode to track its delivery and another to process the payment using a payment terminal. This setup is not only cumbersome and inconvenient, it also increases costs for the business.

Integrating the two functions—payment processing and barcode scanning—into a single device offers a solution to this efficiency challenge. Businesses can then streamline their operations and enhance the overall experience for both their customers and merchants. In the following paragraphs, we will discuss how technologies like mobile POS solutions can address this issue and revolutionize in-person payments.

Payment process description

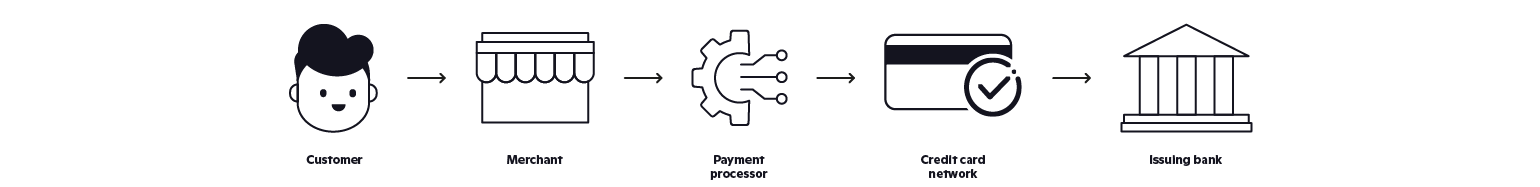

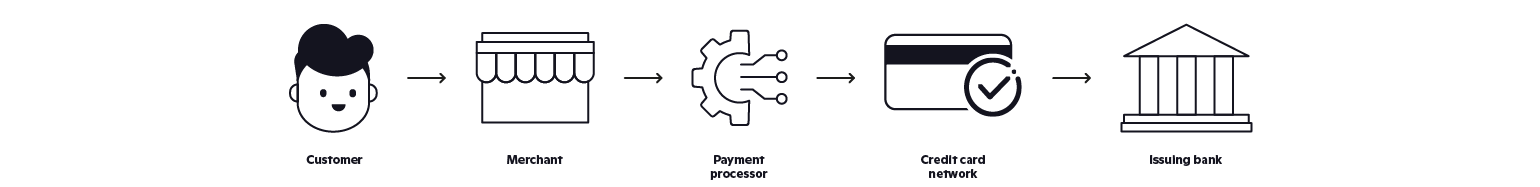

For merchants who want to integrate in-person card payments into their existing mobile app, it's necessary to understand the payment processing system. When a customer uses a credit card as a payment method during an in-person transaction, the transactional details are sent to a payment processor.

The payment processor validates the data and processes the money transfer. It fetches encrypted data, checking if there is enough money to make the purchase with the issuing bank. Once validated, the transaction data is sent to a credit card network, which checks the transaction against the card details and either approves or denies it. If approved, the credit card network facilitates the transfer of funds from the customer's bank to the merchant's bank account.

Mobile point-of-sale solutions

A mobile point-of-sale system, also known as mPOS, is a contactless payment method that enables merchants to use their mobile devices as point-of-sale terminals for accepting payments. This eliminates the need for additional hardware, as payments can be accepted wherever there is an internet connection.

The device that will act as the POS terminal needs to have NFC capability. It's important to note that this solution will only work for payments made with cards that support contactless payment or with cards stored in a mobile wallet. You might need to consider a workaround for customers without a card featuring these capabilities.

Additionally, the solution must take into account the limit for contactless payments and the possibility to enter a PIN. As a result, mPOS providers will offer a range of options that allow merchants to tailor them to their specific needs.

Integration methods and solution providers

Integrating in-person card payments into an existing mobile app can be done in three ways: using a deep link, employing a white label app, or making use of an SDK.

A deep link is a solution that allows the mobile app and payment processor to interact, enabling the app to accept payments. To use this option, merchants must install a payment processing app provided by a third-party vendor. During point-of-sale processing, the customer can choose to pay through the mobile app, which then seamlessly switches over to the payment flow. Once the payment is processed, the customer is redirected back to the original app. This simple solution is quick and inexpensive to implement, with little to no impact on the existing app.

A white label app, on the other hand, is a prebuilt application that can be modified to include branding, which businesses can use for payments within their mobile app. This solution typically includes all the necessary features such as payment processing, transaction reporting, customer management, and security compliance. Leveraging this sort of app saves time and resources as it reduces the need to develop an in-house payment solution from scratch. This option allows for easy customization of user interface and experience to match the existing branding, thus ensuring cohesion and familiarity for customers.

And finally, an SDK, or software development kit, is the most comprehensive option, allowing developers to build custom payment solutions using existing components. An SDK typically includes a collection of tools, libraries, and documentation that guide and support developers in creating tailored, feature-rich mobile apps that integrate seamlessly with existing systems. This approach offers a high degree of flexibility, enabling businesses to create bespoke payment experiences that cater to their specific requirements and their customers’ expectations. While an SDK might take more time and resources to develop and implement, it provides the highest degree of control over the payment process, user experience, and security features. This means you can fully align the implementation with your business goals and vision.

For example, Softpay is currently working on an SDK that will be available later this year. It will be certified against the new security standards (PCI Mobile Payments on COTS, i.e. MPoC) and will be compatible with Zebra scanning devices, which are one of the most commonly used scanners on the market. Alternatively, Phos offers an SDK that is available now, with rates of 1.50% for cards issued within the EU, and 2.00% for other cards.

Established payment processors like Stripe, Square, PayPal, and SumUp have also developed their own alternatives for in-person payments. All in all, there is a wide variety of options, so it is crucial to do your research and select one that best fits your business needs.

Conclusion

Integrating in-person payments into an existing mobile app can be an effective way to improve efficiency and customer experience for businesses that require payment at the point of sale. With an mPOS system, the need for additional hardware is eliminated, allowing for payments to be accepted wherever there is an internet connection.

Despite the current limitations of the systems, the sector is growing rapidly. More and more payment processors are developing their own solutions that will soon be available, so the best time to start exploring your options is now. However, it is important to research potential providers and pick a solution that meets the specific needs of the business; where some will be content with a simple deep link, others might prefer more extensive alternatives, such as an SDK.

If you are a business that would benefit from integrating contactless payments into your mobile app, reach out to us. We will be happy to tell you more about the different options available, help you analyze the requirements for your enterprise, and assist you in designing and implementing the most suitable solution.